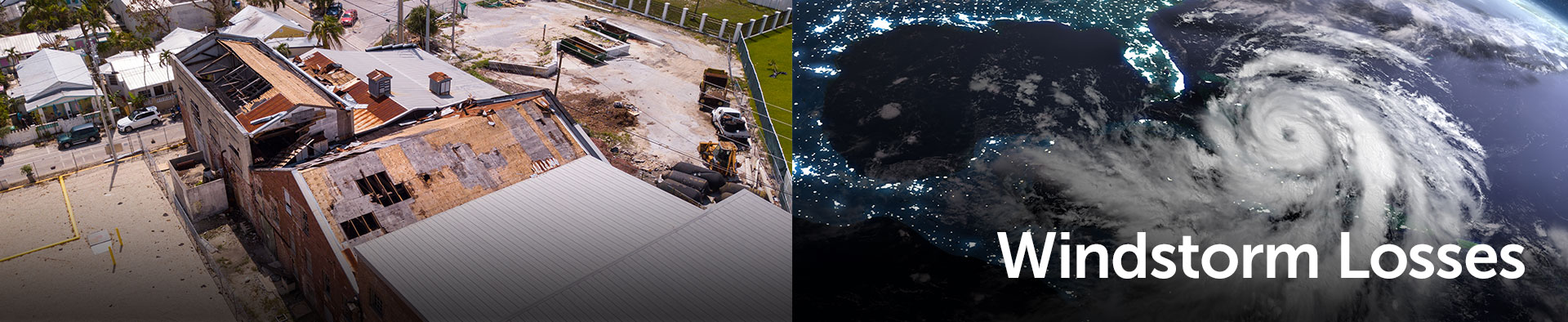

You safely evacuated the hurricane only to return and find your building devastated by the storm’s winds. You call your insurance company and the first thing out of their mouth is a claim denial claiming the damage to your business was a result of flooding rather than the hurricane or windstorm. This is called causation and is one of the top maneuvers used by insurance companies to deny casualty hurricane claims.

Other considerations include the damage your business may suffer as a result of wind or rain (or both) in the subsequent days and weeks after the hurricane.

The attorneys at Roselli & Associates are extremely familiar with causation and other tactics used by insurance companies to deny windstorm claims. Our attorneys know Florida law and are fully prepared to fight on your behalf so your business may recover what is duly entitled. Our legal team has extensive experience representing business who have suffered high-value losses from windstorm damage and will assist handling coverage disputes involving denied claims, delayed payments, underpayment of claims and claims of bad-faith insurer.

Windstorm insurance policies can be difficult to read and interpret. Let us assist you in understanding your insurance documents including:

- Policy coverage

- Policy benefits

- Limitations and/or exclusions

- Defense and indemnification in the event of a claim

The claim information you present to your insurance company and your recovery strategy are crucial to your settlement.

Let us review your damage and asses the best way to proceed with your claim. Complete the short form on this page to get started.